Foam Cushioning Market Trends and Companies Revenue Share 2026-35

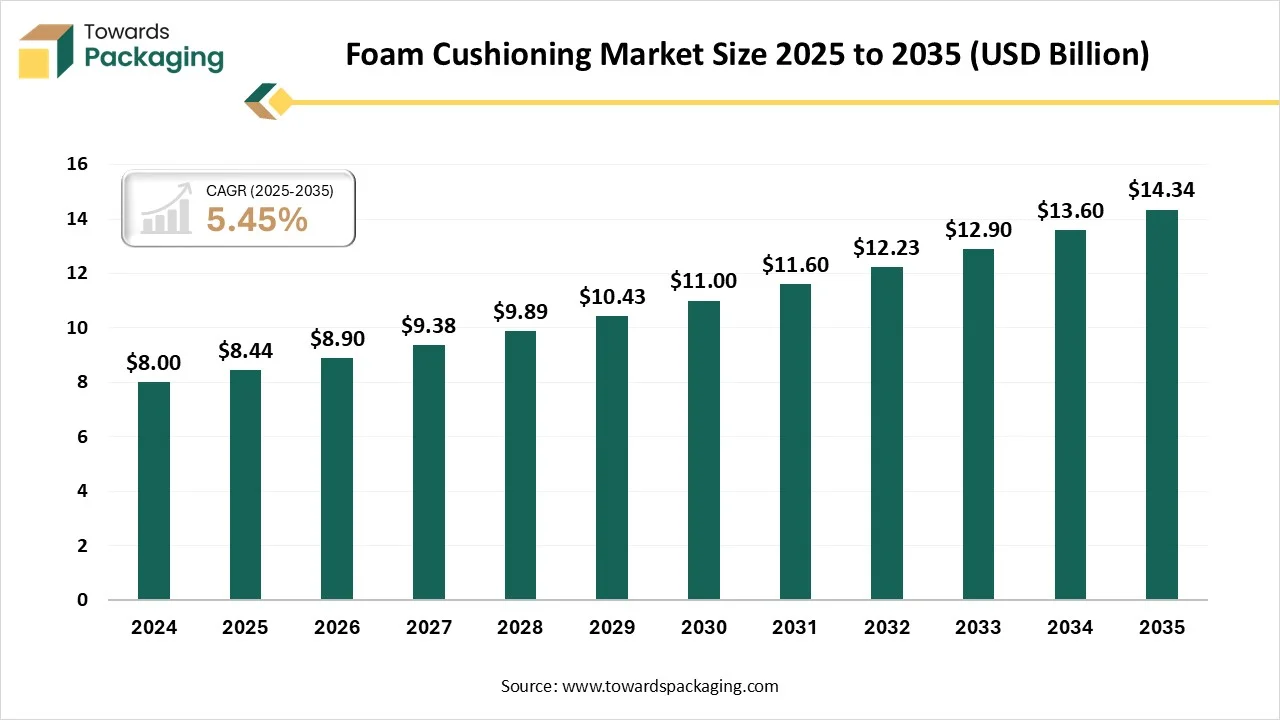

According to projections from Towards Packaging, the global foam cushioning market is set to increase from USD 8.90 billion in 2026 to nearly USD 14.34 billion by 2035, reflecting a CAGR of 5.45% during 2026 to 2035.

Ottawa, Feb. 17, 2026 (GLOBE NEWSWIRE) -- The global foam cushioning market reached approximately USD 8.44 billion in 2025, with projections suggesting it will climb to USD 14.34 billion in 2035, according to a report from Towards Packaging, a sister firm of Precedence Research. The growth of the market is driven by the rising demand for comfortable, durable furniture and bedding, alongside increasing protective packaging needs in various sectors fuels the growth.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by the foam cushioning?

Foam cushioning refers to lightweight, cellular plastic materials designed to absorb shock, vibration, and impact to provide comfort, support, or protection. Used extensively in furniture, mattresses, and packaging, this material offers durable, customizable cushioning that retains its shape. It is characterized by its density and, in the case of polyurethane foam, is a thermosetting polymer that provides high resilience and long-lasting, firm, or soft support.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5937

Private Industry Investments for Foam Cushioning:

- Carpenter Co.'s Acquisition of Recticel Engineered Foams: This major deal aimed to create the world’s largest vertically integrated manufacturer of polyurethane foams by expanding global production and innovation assets.

- BASF’s Polyurethane Production Expansion: The chemical leader invested in increasing its global capacity by 100,000 tons per year to specifically target rising demand in the automotive and construction cushioning sectors.

- Shree Malani Foams' New Manufacturing Plant: This company invested ₹55 crore in a new facility in Odisha, India, to produce 6,000 tonnes of polyurethane foam for the mattress and furniture markets.

- Carpenter Co.'s Downstream Investment in Casper Sleep: By acquiring the prominent mattress brand, the manufacturer integrated vertically to secure a direct-to-consumer channel for its bedding and cushioning products.

-

Carlisle Companies' Acquisition of ThermaFoam: Completed in early 2025, this acquisition was designed to bolster a portfolio of expanded polystyrene products used for high-performance insulation and protective cushioning.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

What Are the Latest Key Trends in the Foam Cushioning Market?

- Sustainability & Eco-Friendly Solutions: A primary driver is the shift toward bio-based, recycled, and sustainable polyurethane (PU) foams to meet environmental regulations and consumer demand for green products.

- Rapid Growth of Flexible Foam: Flexible foam is witnessing high demand due to its superior cushioning, lightweight, and comfort properties, particularly in furniture and automotive seating.

-

Technological Advancements in Specialty Foams: The development of memory foams, as well as smart, adaptive cushioning materials that offer enhanced personalized support, is trending.

What is the Potential Growth Rate of The Foam Cushioning Industry?

The global foam cushioning industry is experiencing steady growth, driven by increasing demand from the furniture, bedding, automotive, and packaging industries, which fuels the growth of the market. The shift toward electric vehicles (EVs) and the need for lightweight, noise-vibration-harshness (NVH) dampening, and comfortable seating is driving high demand for flexible PU foam. Rising environmental concerns are driving research and adoption of bio-based polyols and recyclable foam materials, fueling the growth of the market.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Regional Analysis:

Who is the leader in the Foam Cushioning Market?

Asia Pacific has dominated the global market by holding the highest market share in 2025, fueled by rapid urbanization, rising disposable incomes, and expanding furniture and bedding production. The region’s booming e-commerce sector significantly increases demand for protective packaging foams. Strong automotive manufacturing hubs and increasing construction activities further accelerate market growth.

China Foam Cushioning Market Growth Trends

China is the dominant contributor, benefiting from its massive manufacturing ecosystem for furniture, consumer goods, and vehicles. Large-scale production capabilities, competitive pricing, and growing domestic consumption support strong foam demand. The country is also witnessing a shift toward higher-quality and environmentally friendly cushioning products as consumer expectations evolve.

How is North America experiencing significant growth in the Foam Cushioning Industry?

North America is experiencing significant growth in the market in forecate period, supported by strong demand from furniture, bedding, automotive interiors, and packaging applications. The region emphasizes comfort, durability, and sustainability, pushing manufacturers toward advanced polyurethane and specialty foam solutions. Growth in e-commerce packaging, medical bedding, and ergonomic products further contributes to expanding consumption across residential and commercial sectors.

U.S. Foam Cushioning Market Trends

The U.S. dominates regional demand due to its large furniture and mattress industry, well-established automotive production, and expanding logistics sector. Rising consumer preference for premium comfort products and eco-friendly materials is encouraging innovation in recyclable and bio-based foams. Additionally, growth in healthcare infrastructure and protective packaging for online retail continues to strengthen the domestic market outlook.

Segment Outlook

Foam Material

How Did Polyethylene (PE) Foam Segment Dominate the Foam Cushioning Market?

The polyethylene (PE) foam segment dominated the market in 2025, due to its lightweight structure, excellent energy absorption, and strong resistance to moisture and chemicals. The material is increasingly preferred in reusable transport packaging, automotive parts protection, and electronics due to its durability and recyclability. Growth in sustainable packaging initiatives and the shift toward returnable transit packaging solutions are further driving demand for polypropylene foam across logistics-intensive industries.

The EPP (expandable polypropylene) foam segment is projected to grow at the fastest rate in the market for the forecast period, as it represents a high-performance cushioning material valued for its superior impact resistance, thermal insulation, and multi-impact durability. It is extensively utilized in protective packaging where repeated handling and shock absorption are critical. Rising demand from automotive components, appliances, and high-value electronics shipping continues to expand EPP usage, particularly as companies seek materials that combine lightweight properties with long service life.

Product Type

Which Product Type Segment Dominates the Foam Cushioning Market?

The foam sheets and rolls segment dominated the market in 2025, offering flexibility, easy customization, and compatibility with automated packing operations. They are widely used for surface protection, void filling, and layering between products during transportation. The growth of large-scale warehousing and fulfillment centers has increased the adoption of roll formats, which improve packaging speed while reducing material waste and labor costs.

The foam wraps segment is projected to grow at the fastest rate in the market for the forecast period, as they are designed for quick application around fragile or irregularly shaped goods, providing cushioning, scratch resistance, and vibration protection. Expanding e-commerce shipments and the need for efficient last-mile protection are major factors accelerating the demand for a convenient, easy-to-handle wrap solution.

More Insights of Towards Packaging:

- Mono-Material Cosmetic Tubes Market Growth, Trends & Forecast (2025-2035)

- U.S. Beer Packaging Market Size and Trend, Segment Outlook (2026–2035)

- Cold Chain Packaging Refrigerants Market Size, Trends and Segments (2026–2035)

- Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- Heavy-Duty Corrugated Bulk Boxes Market Size and Segments Outlook (2026–2035)

- Next-Gen Paper & Fiber-Based Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Flow Wrap Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- India Molded Pulp Packaging Market Size, Trends and Segments (2026–2035)

- Clear Plastic Film Market Size, Volume, Price and Trends (2026 - 2035)

- Polyethylene Films Market Size, Trends and Volume (2026-2035)

- Thin Wall Packaging Market Size and Segments Outlook (2026–2035)

- Dunnage Packaging Market Size, Trends and Segments (2026–2035)

- Liquid Packaging Market Size and Segments Outlook (2026–2035)

- Food Packaging Market Size, Trends and Segments (2026–2035)

- U.S. Seed Packaging Market Size and Segments Outlook (2026–2035)

- Europe Pharmaceutical Glass Packaging Market Size, Trends and Segments (2026–2035)

- Uncoated Paperboard For Luxury Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Consumer Packaged Goods (CPG) Market Size, Trends and Competitive Landscape (2026–2035)

- Automotive Parts Packaging Market Size, Trends, Share and Innovations

- North America Yogurt, Cheese & Meat FFS Packaging Market Size, Trends and Segments (2026–2035)

Application

How Did the Protective Packaging Segment Dominate the Foam Cushioning Market?

The protective packaging segment dominated the market in 2025, driven by the growing need to minimize product damage during transportation and storage. Industries rely on foam materials to absorb shock, prevent abrasion, and maintain product integrity across global supply chains. Increasing shipment volumes, cross-border trade, and the rise of high-value goods distribution continue to strengthen demand in this segment.

The electronics & appliances protection segment is projected to grow at the fastest rate in the market for the forecast period, as it requires advanced cushioning solutions to safeguard delicate components from electrostatic discharge, vibration, and impact. Rising global consumption of consumer electronics, smart appliances, and industrial equipment supports steady growth in specialized foam solutions tailored for precision protection.

End-User

Which End-User Segment Dominates the Foam Cushioning Market?

The e-commerce & retail Packaging segment dominated the market in 2025, fueled by the surge in online shopping and direct-to-consumer delivery models. Companies prioritize reliable cushioning to reduce return rates and enhance customer satisfaction. Foam solutions are increasingly integrated into automated packing lines, enabling faster fulfillment while ensuring adequate protection for a diverse mix of products.

The industrial & machinery segment is projected to grow at the fastest rate in the market for the forecast period, as it requires heavy-duty cushioning capable of protecting large, high-value equipment during shipping and long-distance logistics. Growing industrial exports and complex global supply chains are supporting greater adoption of engineered foam cushioning products in this segment.

Recent Breakthroughs in the Foam Cushioning Industry

In November 2025, PUMA launched the MagMax NITRO™ 2 running shoe, the second generation of its max-cushion line. This shoe features a full-length NITROFOAM midsole designed for cushioning and energy return for everyday and long-distance runs, and is 15g lighter than the original while maintaining significant stack height.

In June 2025, Nike introduced the Vomero Plus and Vomero Premium, expanding its maximum-cushioning footwear lineup. The Vomero Plus boasts a 45mm stack height with a full-length ZoomX foam midsole, while the Vomero Premium, which currently stands as Nike's most cushioned road shoe, features a 55mm heel stack height that merges ZoomX foam with visible Air Zoom units.

Top Companies in the Foam Cushioning Market & Their Offerings:

Tier 1:

- Alpha Foam Ltd.: Manufactures Polyurethane (PU) and Polyethylene (PE) foams specifically for automotive seating and protective industrial packaging.

- Goldcoin Foam Pvt. Ltd.: Specializes in Expanded Polyethylene (EPE) and XLPE foams for thermal insulation and impact-resistant cushioning.

- IRE-TEX Premier India Pvt. Ltd.: Provides heavy-duty EPE foam sheets and rolls designed for industrial shock absorption and surface protection.

- Jumax Foam Pvt Ltd: Produces filler-free PU foams in flexible and rigid grades for the automotive, footwear, and furniture sectors.

- M.H. Polymers Pvt. Ltd.: Manufactures a diverse range of PU foams used primarily for mattresses, pillows, and upholstered sofa cushioning.

- Premratan Concast Pvt Ltd. (PyareLal Group): Offers high-quality PU, memory, and rebonded foams tailored for luxury bedding and hospital mattresses.

- Royal EPE Foam Private Limited: Focuses on anti-static and non-cross-linked EPE foam solutions for electronics and industrial packaging.

- Sarva Foam Industries Pvt. Ltd: Specializes in eco-friendly rebonded PU foam used as durable cushioning cores for the bedding and automotive industries.

-

Rogers Corporation: Supplies high-performance silicone and polyurethane foams for precision sealing, gap filling, and advanced vibration damping.

Tier 2:

- Sealed Air Corporation

- DuPont

- The Dow Company

- Nova Chemicals Corp

Segment Covered in the Report

By Foam Material

- Polyethylene (PE) Foam

- Cross-Linked PE Foam

- Non-Cross-Linked PE Foam

- Closed-Cell PE Foam

- Open-Cell PE Foam

- Laminated PE Foam

- Polyurethane (PU) Foam

- Flexible PU Foam

- Rigid PU Foam

- High-Density PU Foam

- Low-Density PU Foam

- Memory Foam (Viscoelastic PU Foam)

- Expanded Polystyrene (EPS) Foam

- Beaded EPS Foam

- Moulded EPS Foam

- Extruded EPS Foam

- White EPS Foam

- Recycled EPS Foam

- Extruded Polystyrene (XPS) Foam

- High-Density XPS Foam

- Low-Density XPS Foam

- Grey XPS Foam (with enhanced insulation properties)

- Recycled XPS Foam

- EPE (Expanded Polyethylene) Foam

- Cross-Linked EPE Foam

- Non-Cross-Linked EPE Foam

- High-Density EPE Foam

- Low-Density EPE Foam

- EPE Foam with Anti-static Properties

- EPP (Expandable Polypropylene) Foam

- Solid EPP Foam

- EPP Foam Beads

- EPP Foam Blocks

- EPP Foam Sheets

- Bio-based / Sustainable Foams

- Biodegradable Polyurethane Foam

- Plant-Based Polyethylene Foam

- Algae-based Foam

- Hemp-based Foam

- Recycled Foam (from post-consumer materials)

By Product Type

- Foam Sheets & Rolls

- Pre-Cut Foam Sheets

- Foam Rolls (Flexible or Rigid)

- Acoustic Foam Sheets

- Anti-static Foam Sheets

- Foam Blocks

- High-Density Foam Blocks

- Low-Density Foam Blocks

- Custom Foam Blocks

- Moulded Foam Blocks

- Recycled Foam Blocks

- Foam Inserts & Die-Cut Components

- Custom Die-Cut Foam Inserts

- Foam Inserts for Packaging

- Foam for Electronics Protection

- Foam Inserts for Industrial Equipment

- Foam Pads & Cutouts

- Foam Pillows & Pads

- Memory Foam Pillows & Pads

- Contoured Foam Pillows

- Cushion Foam Pads

- Foam Pillows for Shipping & Storage

- Medical Foam Pads

- Foam Wraps

- Foam Sheets for Wrapping

- Foam Bubble Wrap

- Protective Foam Wraps

- Anti-static Foam Wraps

- Foam Wraps for Fragile Items

- Molded Foam Cushions

- Molded Cushion Pads for Packaging

- Molded Foam Cushions for Furniture

- Molded Foam Cushions for Automotive Seats

- Molded Foam Cushions for Electronics

- Molded Foam Cushions for Medical Equipment

By Application

- Protective Packaging

- Automotive Cushioning & Interior Components

- Furniture & Bedding Cushioning

- Sports & Leisure Equipment

- Electronics & Appliances Protection

- Medical & Healthcare Cushioning

By End-Use Industry

- E-commerce & Retail Packaging

- Automotive

- Electronics & Consumer Goods

- Furniture & Home Décor

- Industrial & Machinery

- Healthcare & Medical Devices

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution:

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- U.S. Black Rigid Plastic Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Refillable Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Dairy Product Packaging Market Size and Segments Outlook (2026–2035)

- Middle East Seafood Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Middle East Packaging Machinery Market Size, Trends and Segments (2026–2035)

- Biofoam Packaging Market Size and Segments Outlook (2026–2035)

- Sanitary Food and Beverage Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ready-to-Use Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Size, Trends and Competitive Landscape (2026–2035)

- Asia Pacific Food Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Europe Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- North America Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- North America Post-Consumer Recycled Plastics Food Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Transfer Molded Pulp Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Food Packaging Market Size and Segments Outlook (2026–2035)

- Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

- North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.