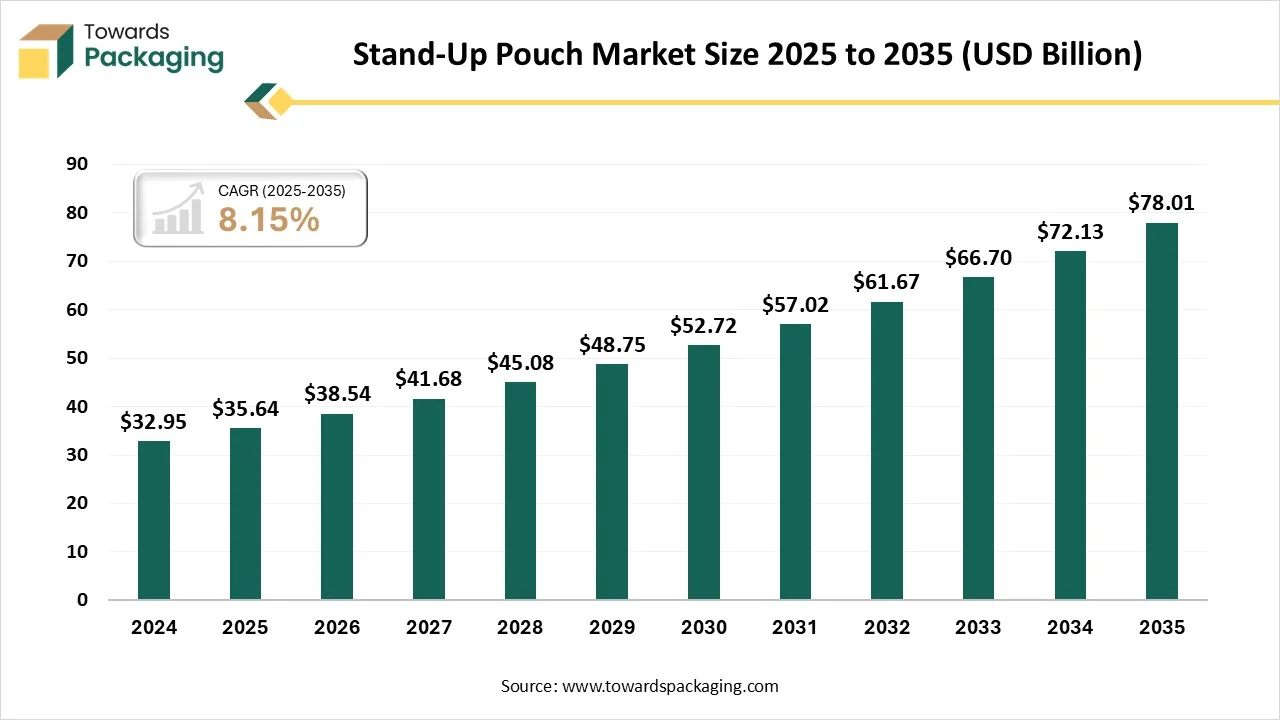

Stand-Up Pouch Market Projected Growth from USD 35.64 Billion in 2025 to USD 78.01 Billion by 2035, with a CAGR of 8.15%

According to researchers from Towards Packaging, the global stand-up pouch market, estimated at USD 35.64 billion in 2025, is forecast to expand to USD 78.01 billion by 2035, growing at a CAGR of 8.15% over the forecast period. By region, Asia Pacific dominated the global market with approximately 43% share in 2025, and South America is expected to grow at the fastest CAGR from 2026 to 2035.

Ottawa, Feb. 19, 2026 (GLOBE NEWSWIRE) -- The global stand-up pouch market stood at USD 35.64 billion in 2025 and is projected to reach USD 78.01 billion by 2035, according to a study published by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by Stand-Up Pouch?

A stand-up pouch is a flexible packaging format with a gusseted bottom that lets it stand upright on shelves while protecting contents from moisture, air, and light. Its strategic importance has grown as brands seek lightweight, space-efficient, visually appealing, resealable, and increasingly sustainable packaging that enhances product visibility, reduces material and transport costs, and aligns with consumer demand for convenience and eco-friendly solutions.

Private Industry Investments for Stand-Up Pouch:

- UFlex Global Expansion: UFlex Limited secured a major INR 1,500 crore investment from the Aditya Birla Group in 2024 to expand its flexible packaging and aseptic pouch manufacturing capacity.

- Butterfly Equity’s ePac Acquisition: In January 2026, Butterfly Equity acquired ePac Flexible Packaging to accelerate the growth of digitally printed stand-up pouches for small and medium-sized brands.

- Amcor Facility Expansion: Amcor plc invested in its Tamil Nadu plant in 2024 to increase pouch and film production capacity by 30% to meet rising demand in the Indian market.

- Edgewater Funds’ Build-up Strategy: The Edgewater Funds acquired Flexible Packaging Specialties, Inc. (FPS) in late 2024 to consolidate manufacturers specializing in custom stand-up pouches and laminated roll stock.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5949

What Are the Latest Key Trends in the Stand-Up Pouch Market?

1. Sustainability and Eco-Friendly Materials

The market is shifting toward recyclable, biodegradable, and mono-material pouches to reduce environmental impact and meet consumer demand for greener packaging. Plant-based polymers, compostable films, and recyclable designs support circular economy goals and strengthen brand sustainability credentials.

2. Advanced Barrier Films

Enhanced high-barrier films protect contents from oxygen, moisture, and light, extending product shelf life without bulky packaging. These materials are increasingly used across food, beverages, and sensitive products, balancing sustainability with performance and freshness preservation.

3. Smart and Interactive Packaging

Integration of QR codes, NFC tags, and other digital tools boosts consumer engagement, enables traceability, and delivers interactive brand experiences. Smart features also provide product authenticity, sustainability information, and direct access to promotions or loyalty programs.

4. Functional Convenience Features

Consumers prefer stand-up pouches with resealable zippers, spouts, easy-pour designs, and tear notches. These features enhance usability, preserve freshness, and suit on-the-go lifestyles, particularly for snacks, liquids, and household products.

5. Customization via Digital Printing

Digital printing enables vibrant, high-quality graphics, short runs, and personalized packaging. This trend helps brands stand out on crowded shelves, support seasonal or limited editions, and respond quickly to market trends with tailored designs.

6. E-commerce-Driven Demand

The growth of online retail increases demand for lightweight, durable, and visually appealing pouches. Stand-up formats reduce shipping costs, offer strong shelf presence, and meet consumer expectations for convenience in e-commerce deliveries.

What is the Potential Growth Rate of the Stand-Up Pouch Industry?

As of the latest 2026 market forecasts, industry research shows the stand-up pouch industry growing at a robust yet varied pace, depending on the source and segment focus. Broad global analyses indicate growth rates ranging roughly between mid-single to high-single digits annually, reflecting sustained demand for lightweight, convenient, and sustainable flexible packaging across food, beverage, personal care, and household sectors.

This momentum is underpinned by regulatory emphasis on recyclability, rising adoption in e-commerce and convenience foods, regionally strong expansion in Asia-Pacific manufacturing, and innovation in materials and closures that together support stable long-term growth.

More Insights of Towards Packaging:

- North America Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- North America Post-Consumer Recycled Plastics Food Packaging Market Size and Segments Outlook (2026–2035)

- Europe Transfer Molded Pulp Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Food Packaging Market Size and Segments Outlook (2026–2035)

- Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

- North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

- Next-Generation Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Recycled Materials Packaging Solutions Market Size and Segments Outlook (2026–2035)

- Commercial Printing Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Films Market Size and Segments Outlook (2026–2035)

- Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

- Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- South Korea Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Germany Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- U.S. Glass Packaging Market Size and Segments Outlook (2026–2035)

Regional Analysis:

Who is the leader in the Stand-Up Pouch Market?

The Asia-Pacific region dominates the market due to several key factors. Rapid urbanization and expanding middle-class populations in China, India, and Southeast Asia are driving significant demand for convenient, packaged foods and beverages that stand-up pouches support. Strong manufacturing capabilities and cost-competitive production reduce packaging costs and attract both local and global converters.

Additionally, growing e-commerce and modern retail channels increase the need for lightweight, durable, visually appealing flexible packaging. Sustainability initiatives and rising consumer preference for recyclable or eco-friendly solutions further bolster regional adoption and strategic importance in global markets.

China Stand-Up Pouch Market Trends

China’s leadership in the Asia-Pacific market stems from its massive consumer base, extensive flexible packaging ecosystem, and cost-efficient production infrastructure, enabling high-volume output at competitive prices. The country benefits from advanced converting technologies, sophisticated digital printing, well-developed supply chains, and major export hubs, while strong domestic e-commerce growth and supportive policies accelerate innovation and adoption of sustainable pouch formats.

How is the Opportunistic is the Rise of Latin America in the Stand-Up Pouch Industry?

The Latin America region is expected to grow at the fastest CAGR in the market, driven by structural shifts in its packaging and retail landscape. Rapid expansion of organized retail chains and cross-border e-commerce is increasing demand for durable, lightweight packaging that reduces logistics costs.

Brazil and Mexico are strengthening local converting capacities, while rising processed food exports encourage high-barrier pouch adoption. Regional sustainability policies and investment in recyclable flexible films further position Latin America as a fast-emerging manufacturing and consumption hub.

Brazil Stand-Up Pouch Market Trends

Brazil’s strength in stand-up pouch manufacturing lies in its vertically integrated packaging value chain, supported by strong domestic resin production and a mature flexible converting industry. The country has specialized expertise in high-barrier laminates for meat, coffee, and dairy exports. Concentrated industrial clusters in São Paulo improve logistics efficiency, while established relationships with major food processors enable scale, customization, and faster commercialization of innovative pouch formats.

How Big is the Opportunity for Growth of the North America Region in Market?

North America presents a significant growth opportunity in the stand-up pouch industry as consumer demand shifts toward convenient, portable, and sustainable packaging formats across food, beverage, pet food, and personal care segments. The region’s mature manufacturing base, strong e-commerce fulfilment, advanced printing and barrier film technologies, and increasing adoption of recyclable and high-performance pouches make it an attractive expansion zone for brands and converters alike.

Segment Outlook

Material Type Insights

What made the Polyethylene Segment Dominant in the Stand-Up Pouch Market?

The polyethylene segment leads the market due to its strong balance of cost efficiency, processability, and performance. It offers excellent heat-sealing properties, flexibility, and moisture resistance, making it suitable for food, personal care, and household applications. Polyethylene is widely compatible with mono-material pouch designs, supporting recyclability targets.

The biodegradable film segment is estimated to be the fastest growing segment in the market because brands and regulators are pushing for environmentally responsible packaging that reduces plastic waste. Consumers increasingly prefer packaging that breaks down more easily after use, and manufacturers are investing in compostable polymers and bio-based films that meet performance needs.

Closure Type Insights

How the Zipper/Resealable Closures Dominated the Stand-Up Pouch Market?

The zipper/resealable closure segment dominates because it enhances convenience and product freshness, which are top priorities for consumers. Resealable pouches reduce spills, support multiple uses, and improve storage life for snacks, pet food, and household products. Brands increasingly adopt resealable features to differentiate on shelf and meet expectations for easy‑open, easy‑close packaging that aligns with on‑the‑go lifestyles and repeat usage.

The hook/loop closures segment is expected to grow at highest CAGR in the market because it provides enhanced convenience, secure resealing, and easy handling for bulky or frequently used products. Commonly applied in pet food, grains, and powdered goods, this closure type supports repeated use, preserves product freshness, and appeals to consumers seeking functional, practical packaging for everyday storage and on-the-go applications.

Product Type Insights

What made the Flat Stand-Up Pouches Segment Dominant in the Stand-Up Pouch Market?

The flat stand-up pouch segment dominates because it combines cost-effectiveness, shelf stability, and versatility for a wide range of products, from snacks to powders. Its simple structure allows easy filling, efficient storage, and strong shelf presence. Manufacturers favour flat pouches for their lightweight design, compatibility with various sealing methods, and adaptability to branding and labeling, making them ideal for mass-market applications.

The shaped/custom stand-up pouches segment is estimated to be the fastest-growing segment in the market because it enables unique, eye-catching designs that enhance brand differentiation and shelf appeal. These pouches cater to premium, niche, and limited-edition products, allowing tailored shapes, handles, or spouts. Their versatility in design and marketing potential drives adoption in snacks, beverages, pet food, and personal care categories.

End-Use Industry Insights

How the Food and Beverage Dominated the Stand-Up Pouch Market?

The food and beverage segment dominates the market because these pouches offer convenience, extended shelf life, and protection against moisture and contamination, crucial for perishable products. Their lightweight, flexible design reduces transportation costs, while resealable and spouted options enhance usability. High consumer demand for snacks, ready-to-eat meals, beverages, and packaged fresh foods further drives adoption.

The industrial & household products segment is expected to be the fastest-growing segment because stand-up pouches offer durable, leak-resistant, and convenient packaging for detergents, chemicals, and cleaning supplies. Reusable, lightweight designs simplify storage and handling, while spouts, resealable zippers, and reinforced films improve user safety and product protection.

Thickness insights

What made the Below 100 microns Segment Dominant in the Stand-Up Pouch Market?

The below 100-micron segment dominates because thinner films offer lightweight, cost-efficient, and flexible packaging without compromising strength for many food, beverage, and personal care products. This thickness allows efficient material use, easier sealing, and reduced transportation costs, while maintaining adequate barrier protection.

The custom thickness segment is expected to be the fastest-growing segment in the market because it allows manufacturers to tailor pouches for specific product requirements, such as heavier powders, liquids, or bulk items needing extra strength. Adjustable film thickness enhances durability, puncture resistance, and barrier performance, while optimizing material use.

Recent Breakthroughs in the Stand-Up Pouch Industry

- In January 2026, Xplendis Locker unveiled a new stand-up pouch for its Tortina Mini range in early 2026, designed to cater to on-the-go consumers and portion-controlled snacking. The innovative packaging enhances product visibility, preserves freshness, and offers convenience with easy handling.

- In December 2025, DQ Pack, a company that provides printing solutions and customized flexible packaging introduced a high-temperature retort stand-up pouch with an integrated spout, suitable for soups, sauces, ready-to-eat meals, and baby food. The multi-layer pouch withstands sterilization while ensuring easy pouring and resealing.

-

In January 2025, Korozo Group rolled out innovative stand-up pouches for pet food and treats, designed to boost shelf appeal and convey product quality. The packaging focuses on brand differentiation, convenience, and visual engagement, helping manufacturers meet consumer expectations while maintaining product freshness and enhancing overall retail presentation.

Top Companies in the Global Stand-Up Pouch Market & Their Offerings:

Tier 1:

- Amcor plc: Provides the Classic Doypack® featuring high-barrier protection and tactile finishes for retail appeal.

- Mondi Group plc: Offers the re/cycle pouch, a mono-material PE or PP solution designed for easy recycling.

- Smurfit Kappa Group plc: Produces the Pouch-Up®, a lightweight, tap-dispensing pouch primarily for liquid products like wine.

- Sonoco Products Company: Supplies the EnviroFlex® line, specializing in recyclable polyethylene pouches for snacks and pet food.

- ProAmpac LLC: Markets the PRO-POUCH® series, which features customizable closures and shapes for dry food and liquids.

- Berry Global, Inc.: Delivers the Entour™ series, a high-performance, non-laminated pouch that is fully recyclable.

- Sealed Air Corporation: Offers CRYOVAC® brand pouches with specialized oxygen and UV barriers for food freshness.

- Coveris Holdings S.A.: Manufactures MonoFlex™ pouches, a lightweight mono-laminate range that reduces overall plastic usage.

- Huhtamäki Oyj: Produces the blueloop™ series, focusing on mono-material structures for sustainable consumer goods packaging.

- Constantia Flexibles Group GmbH: Provides EcoLam, a mono-PE laminate pouch engineered for maximum recyclability and barrier performance.

Segment Covered in the Report

By Material Type

- Polyethylene (PE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polyethylene Terephthalate (PET)

- PET clear

- PET metallized

- PET coated

- Polypropylene (PP)

- Homopolymer PP

- Copolymer PP

- Aluminum Foil Laminates

- Aluminum foil-based stand-up pouches

- Aluminum foil with plastic lamination

- Biodegradable/Bio-based Films

- PLA (Polylactic Acid)

- PHA (Polyhydroxyalkanoates)

- Other bio-based plastics (e.g., PBS, PBAT)

- Others (Nylon, EVOH…)

- Nylon

- EVOH (Ethylene Vinyl Alcohol)

- Other specialty films

By Closure Type

- Zipper/Resealable Closures

- Single track zippers

- Double track zippers

- Press-to-close zippers

- Tear-Notch

- Standard tear-notches

- Reinforced tear-notches

- Spout Pouches

- Liquid spout pouches

- Powder spout pouches

- Slider Zippers

- Single track slider zippers

- Double track slider zippers

- Hook/Loop Closures

- Hook & loop for stand-up pouches

- Hook & loop for flat pouches

By Product Type

- Flat Stand-Up Pouches

- Quad-Seal Pouches

- Spouted Pouches

- Gusseted Pouches

- Shaped/Custom Stand-Up Pouches

By End-Use Industry

- Food & Beverage

- Pet Food & Treats

- Pharmaceuticals & Nutraceuticals

- Personal Care & Cosmetics

- Industrial & Household Products

By Thickness

- Below 100 Microns

- 100–200 Microns

- Above 200 Microns

- Custom Thickness

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

Invest in Our Premium Strategic Solution:

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

U.S. Molded Pulp Packaging Market Size, Trends and Competitive Landscape (2026–2035)

Vaccine Storage Packaging Market Size, Trends and Segments (2026–2035)

Intelligent Packaging Market Size, Trends and Segments (2026–2035)

Plastic Packaging Market Size and Segments Outlook (2026–2035)

Lightweight Industrial Corrugated Packaging Market Size and Segments Outlook (2026–2035)

Sustainable Aerosol Packaging Market Size, Trends and Segments (2026–2035)

Poly-Woven Packaging Market Size, Trends and Segments (2026–2035)

Mono-Material Cosmetic Tubes Market Growth, Trends & Forecast (2025-2035)

U.S. Beer Packaging Market Size and Trend, Segment Outlook (2026–2035)

Cold Chain Packaging Refrigerants Market Size, Trends and Segments (2026–2035)

Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

Heavy-Duty Corrugated Bulk Boxes Market Size and Segments Outlook (2026–2035)

Next-Gen Paper & Fiber-Based Packaging Market Size, Trends and Regional Analysis (2026–2035)

Flow Wrap Packaging Market Size, Trends and Competitive Landscape (2026–2035)

India Molded Pulp Packaging Market Size, Trends and Segments (2026–2035)

Clear Plastic Film Market Size, Volume, Price and Trends (2026 - 2035)

Polyethylene Films Market Size, Trends and Volume (2026-2035)

Thin Wall Packaging Market Size and Segments Outlook (2026–2035)

Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44 ; sales@towardspackaging.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.